Where’s the Plan? Health and Retirement

Just last week, I attended a workshop titled “Staying Out of Debt and Planning for Your Retirement”. Sounds like a bore, right? Not so much. Though the only incentive offered was free lunch, this workshop was highly attended, and attendees actively took notes and asked questions throughout the entire presentation.

During the workshop, we were asked to create a plan outlining what we want savings for in the future, both in the short term (1-5 years) and the long term (10+ years). Though each attendee had different priorities, everyone’s lists had similarities; luxuries that most people want to have and work their lives towards obtaining. Buying a house, having children, paying for college, traveling, purchasing a new car, and many others were on the list. As I sat in this workshop learning about how to plan for my retirement, it struck me that my retirement savings will mean nearly nothing if I am not healthy. If I were to develop a chronic illness, not only could it potentially be very costly to pay for medications and medical bills, but also without my health, how will I be physically able to enjoy any of the luxuries I worked so hard for?

This led me to the question: why do we plan for our savings and retirement, but not for our health? Imagine if we planned for our health and well-being just like we do for our retirement. What would that look like?

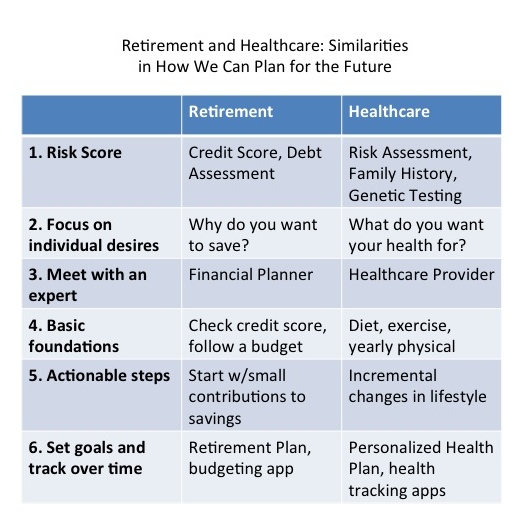

There are many similarities between the planning for retirement and planning for health.

1) It all starts with some kind of risk score.

2) We all want to plan for different, very personal reasons. Each of our plans should be influenced by why we want to save or be healthy.

3) Meeting with an expert is key to creating a successful plan. The expert’s job is to combine your desires with their expertise to create a workable, realistic plan.

4) We all know what everyday choices and actions are going to keep us “healthy”, either financially or physically. Building the right habits is the key to success. Easier said than done, right?

5) Starting early and taking baby steps can make all of the difference. Small steps are the key to success.

6) Overall, these plans should be a road map for how we are going to save or be healthy over time. This requires creating achievable goals and tracking progress using resources available to us.

While retirement planning has become a relatively successful industry, the concept of health planning is still foreign to most of us. With all of the resources and infrastructure available to support retirement, there’s no wonder so many people are taking their planning for retirement so seriously. Bringing the same attitude towards investing in health and well being is something we could all benefit from. We work hard to enjoy retirement in the future, but bettering our health is something we can do now and reap the benefits of right away. The question is, where’s the plan?